Elixir Gateway

“The Trading Edge”

Not all technology solutions are created equal. This cannot be more evident in case of MetaTrader 5 connectivity to clearing firms, liquidity providers and or third-party systems.

Elixir Gateway

Elixir is Direct Market Access Gateway for MetaTrader 5 platform. It is a server level plugin for MetaTrader 5, hence functions as a native component of the MetaTrader 5 trade server. Because of this close integration of ElixirGateway with MetaTrader 5, ElixirGateway become a subsystem available to all MetaTrader 5 sub-systems such as order routing, trade management and accounting to name a few.

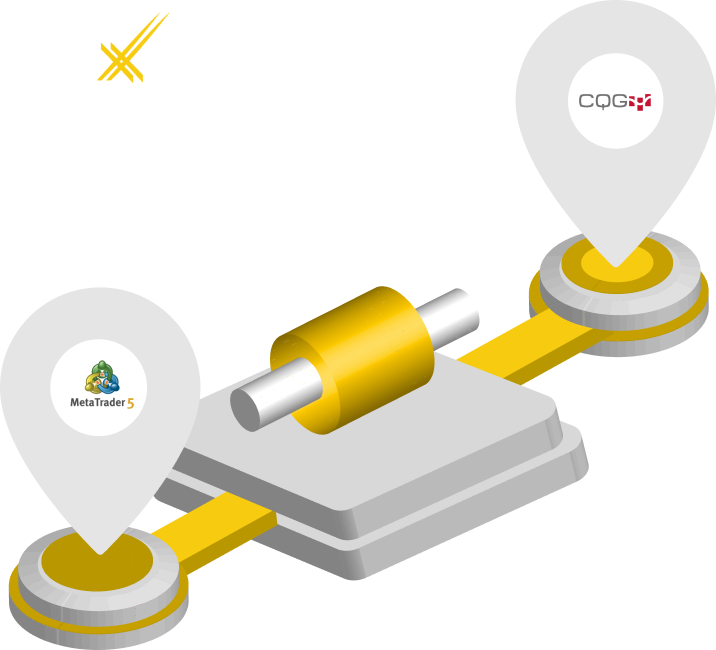

ElixirGateway connects MetaTrader 5 platform to CQG via a direct connection. All trades requests are sent directly to CQG for execution without any additional sub systems such as bridges, aggregation hubs or any third parties in between. Similarly Real-Time data received is without any additional third parties in between the MetaTrader 5 server and CQG.

Faster real-Time Market Data & Order Routing

ElixirGateway – There is nothing like it anywhere in the world for Futures Trading. We are the “Edge” you wanted to compete at the highest levels.

Benefits of Elixir Flare

ElixirGateway – There is nothing like it anywhere in the world for Futures Trading. We are the “Edge” you wanted to compete at the highest levels.

- True Direct Market Access Gateway

- Server Level Risk Management Tools

- Our extensive FCM partner network

- Advanced Productivity and Analytics Tools

By employing a Gateway method rather than a bridge model currently being offered by every other MetaTrader 5 platform operator, we eliminated connections to third parties completely. As a result, several other challenges are solved.

- Slippage is reduced greatly when it comes to market orders, orders are being sent for immediate execution not to third party to be delivered to executions desk.

- Trade order routing and delivery times are reduced by default.

- All orders such as FOK, IOC or Return are sent to execution desk not to a third party. You understand the importance of this if you use MQL 5 programing.

- All trading operations are now native to MetaTrader 5 again.

- Your Take-Profit and Stop-Loss functions are now a local MetaTrader 5 operations not a third-party delivery service with delays.

Constant connection directly between CQG and MetaTrader 5 keeps the accounting in sync. - MetaTrader 5 fail-over is instant. In an event of Main Trader Server failure, the backup server take over does not require any interaction from support or scripts to re-establish connectivity to CQG and retrieve current positions all over again. Gateways works as a native component of MetaTrader 5, so all positions are always in sync, which is not the case with bridges.

- Your trade orders are truly private and cannot be used as a guide by fancy third party systems to place hedged orders by others prior to your orders are forwarded to exchange by the liquidity hub.

- Your Limit Orders are not visible to a third-party as an actionable intelligence for others.

More Information on Gateway vs Bridge

There is currently only one way a MetaTrader 5 can connect to CME for futures trading and its via CQG. There are two ways a MetaTrader can connect to CQG environment. First a bridge method that connects MetaTrader 5 to a third-party hub, which receives the orders and forwards them to CQG and is also the source of Real-Time Market Data feed. This how every MetaTrader 5 other than AxiomaticAI is connected to CQG for futures trading.

Second method is a Gateway, in this model a connection is establish between MetaTrader server and CQG without any third parties in between. All orders are sent directly to CQG for execution and Real-Time Market Data is received directly from CQG as well. so that a trader can get market data, place trades against that market data and manage live trades. Gateway method is how MetaQuotes intended MetaTrader to be used for access to data, liquidity and trade executions.